With Xmas only 4 days away things are quiet but mildly bullish...

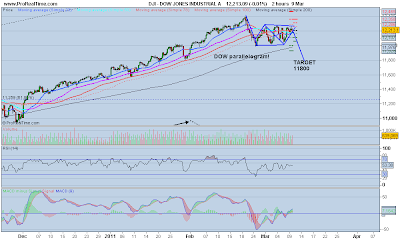

here's a 4 hr chart of the DOW with a bullish inverse head and shoulder Neckline at 12230.. and if we bust through that and a possible retest, target could be +1000 points higher...

Maybe not before Xmas but could be for Q1 2012

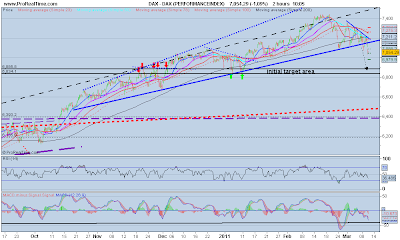

DAX and FTSE have also broken out of recent down trend which could have been FALLING WEDGES..

Technical analysis of Major Markets, F/X, and anything that can be traded This is my diary for trading Views expressed in this are only for educational purposes. They ARE NOT recommendations to BUY or SELL anything!! ALL comments and criticisms welcome.

Quotes

Look back over the past, with its changing empires that rose and fell, and you can foresee the future too.

— Marcus Aurelius

Followers

Search This Blog

Thursday, December 22, 2011

Friday, December 9, 2011

DAX Elliott waves for FUN

Not an expert so more a bit of mental masturbation and a bit of fun whilst waiting for the NEWS !! So it seems everybody is bearish again; VIX at high levels, "shoot sell first , ask questions later" mentality prevailing, well to some the recent fall in the markets may just be a correction of the big run up from 25 Nov lows. Of course the DAX has been sold more than others (Germany at core of Europe, plus inherently more volatile), so here's a look at a POSSIBLE wave count (Elliott Wave, IMHO usually not good at forecasts BUT quite good to look at in retrospect)..

Obviously this is the BULL scenario at least in the Mid term...once wave 2 completes...then the BIG wave 3 down occurs!

Any "experts" on EW more than welcome to comment.

Obviously this is the BULL scenario at least in the Mid term...once wave 2 completes...then the BIG wave 3 down occurs!

Any "experts" on EW more than welcome to comment.

Thursday, December 8, 2011

Waiting for Godot...

Markets marking time especially currency markets...

waiting for the BIG news out of the EU summit..

both charts show the tight range we have eben in since the day the world's Central Banks announced tehir concerted action, resulting in the big spike on November 30th.

Nothing to do but wait !

The AUDUSD looks like it wants to break higher through the 1.029 /1.02 level.

EURO looks like it has found support at 1.33

EURO 30 minutes

Equities also pretty subdued at their highs, DAX is the underperformer, vs DOW and FTSE

waiting for the BIG news out of the EU summit..

both charts show the tight range we have eben in since the day the world's Central Banks announced tehir concerted action, resulting in the big spike on November 30th.

Nothing to do but wait !

The AUDUSD looks like it wants to break higher through the 1.029 /1.02 level.

EURO looks like it has found support at 1.33

EURO 30 minutes

AUDUSD 30 mins

Equities also pretty subdued at their highs, DAX is the underperformer, vs DOW and FTSE

Wednesday, December 7, 2011

CABLE head and shoulders or Double Bottom?

Like many indices it seems that most are universally BEARISH on cable, euro and Aussie dollar vs dollar.

Looking at the daily CABLE (£/$) chart

The BEAR case (head and shoulders) is clearly outlined and would target 1.40 or lower

However there is pretty strong support mid term at the 1.53 level..and we may have already bottomed or one more dip lower before we rally. Also we seems to have broken out of a falling wedge..(bullish)

Be prepared

Sometimes it pays to look at a longer time frame

Looking at the WEEKLY chart

Looking at the daily CABLE (£/$) chart

The BEAR case (head and shoulders) is clearly outlined and would target 1.40 or lower

However there is pretty strong support mid term at the 1.53 level..and we may have already bottomed or one more dip lower before we rally. Also we seems to have broken out of a falling wedge..(bullish)

Be prepared

Sometimes it pays to look at a longer time frame

Looking at the WEEKLY chart

We can see since 2009 a large triangle is playing out which looks like an ASCENDING TRIANGLE.

We are also near the rising trend line forming the bottom of the triangle and resistance is around 1.65

DAX daily..toasted bears on menu?

Yesterday the DAX gapped lower, but today has GAPPED higher..

We are still near the "obvious" resistance" and psychologically many will be looking for the FALL from here. Maybe. BUT if yesterday was the extent of the selling and many are short then the SURPRISE move will be higher and once we breach the "obvious resistance" the next level will be 6400 fairly quickly, where we may pause and trade in the "RESISTANCE AREA" ie 6150 to 6400.

Tomorrow and Friday keep eye out for headlines from the EU summit!

Reading a few blogs, seems like everybody is looking for the markets to fall from here...(contrarian signal)

as always be prepared !! ie PLAN B!!

We are still near the "obvious" resistance" and psychologically many will be looking for the FALL from here. Maybe. BUT if yesterday was the extent of the selling and many are short then the SURPRISE move will be higher and once we breach the "obvious resistance" the next level will be 6400 fairly quickly, where we may pause and trade in the "RESISTANCE AREA" ie 6150 to 6400.

Tomorrow and Friday keep eye out for headlines from the EU summit!

Reading a few blogs, seems like everybody is looking for the markets to fall from here...(contrarian signal)

as always be prepared !! ie PLAN B!!

Tuesday, December 6, 2011

Time for a rest?

Well after the big run up last week, looks like markets want a rest.

Looking at FTSE 4 hr chart, after the break out from that channel, we COULD go as low to retest that channel, but I would say doubtful .

More likely we see some weakness maybe as low as 5400, before the rally gets going again..

CAVEAT: Obviously if we get some "news" out of Europe by end of the week it may accentuate the moves.

EURO has also given back most of it's gains, AUDUSD also weak today after RBA rate cut...

DAX

similar picture to FTSE, looking to buy on weakness..ideally below 6000

Looking at FTSE 4 hr chart, after the break out from that channel, we COULD go as low to retest that channel, but I would say doubtful .

More likely we see some weakness maybe as low as 5400, before the rally gets going again..

CAVEAT: Obviously if we get some "news" out of Europe by end of the week it may accentuate the moves.

EURO has also given back most of it's gains, AUDUSD also weak today after RBA rate cut...

|

| FTSE 4 hr |

DAX

similar picture to FTSE, looking to buy on weakness..ideally below 6000

|

| DAX 4 hour |

Thursday, December 1, 2011

DAX daily ..BULL FLAG

When markets are showing similar patterns usually reinforces the analysis. The DAX also broke what now looks like a BIG bull flag on the daily chart. If so, and referring to my trusted Edwards and Magee, the measured move would be to approx 7200 !!

With a lot of skepticism in the market this could be achieved in the next couple of months. 6145 levels looks like the "OBVIOUS" resistance level..so watching that but like FTSE not expecting a huge pullback..

Maybe strategy is take profits on half and wait for pull back to reload? Unless very nimble shorting may be too much work

FTSE daily update

After yesterday's post , the Central Bank action pushed FTSE through that channel. Reading press and other media, there is still a lot of disbelief in the "rally", so am expecting a relatively small pullback, and another push higher before a more meaningful pullback...

Longer term it seems that there will be a lot of money looking for return, and the world will be awash with liquidity.

Dollar index broke it's rising wedge yesterday, so looking to sell dollars into strength (AUD, GBP and €)

Wednesday, November 30, 2011

The UBER bullish scenario..FTSE...

Well today it looks like quite a few markets are breaking out of what looks like BULL FLAGS on daily charts..albeit quite BIG ones!

As the markets usually like to throw curve balls and the world press are super negative and bearish...what IF???

Just a thought to keep at the back of one's mind...

(that plus the Falling wedges in FX may me adding up to a not so bearish future..medium term)

EURO DOLLAR falling wedge (bullish)

Additional notes after re-reading my Edwards and Magee "Technical Analysis of Stock Trends"...unlike a Rising Wedge ("When prices break out of a Rising Wedge they usually fall away rapidly"), in a Falling Wedge "they are more apt to drift sidewise or in a dull "saucering-around" movement before they begin to rise"

May not be applicable to FX ..but worth watching..

Still BAD news...

European news (bad news) still dominating Financial press and TV media, everybody assuming the rally is a "flash in the pan"...and that EUROPE is DOOMED!!

Still too much negativity..

Expecting a lot of churning still at these levels..buy on weakness

Tuesday, November 29, 2011

Commodities

SILVER

Silver...seems to be at support..around 30 USD. could have a move up to 35, and ideally a move up to 38/40

where it may be a SHORT

COPPER

Copper also looks like finding support at around 325..

Move to 400? on the cards

CRUDE OIL

Slightly different chart...

Broke uptrend last week...now is that enough of a breather for a run to new highs?

Was overbought, recent sell off has reset indicators..

A break of 95 to downside changes bullish view

Silver...seems to be at support..around 30 USD. could have a move up to 35, and ideally a move up to 38/40

where it may be a SHORT

COPPER

Copper also looks like finding support at around 325..

Move to 400? on the cards

CRUDE OIL

Slightly different chart...

Broke uptrend last week...now is that enough of a breather for a run to new highs?

Was overbought, recent sell off has reset indicators..

A break of 95 to downside changes bullish view

DAX daily update

Well the fall out of the chop was a little deeper than expected..BUT we are still in a channel and now approaching a key level 5785.. a break above that and the rally is back on...otherwise we may just trade in the channel.

Things to note..

1. Despite all the negative news markets have not "fallen out of bed" ie they have only given up between 50 - 70 % of the rally from October lows

2. The media are extremely negative on everything.

3. Despite all the negativity surrounding the EURO €, also has held up relatively well

4. Likelihood is that the money is all betting on demise of Euro and Europe...

Looking at the EURO chart

Looks like we could be in falling wedge patterns

If we break out to upside (expected move) then in theory the entire falling wedge will be retraced..

(similar patterns also in AUDUSD and GBPUSD)

Things to note..

1. Despite all the negative news markets have not "fallen out of bed" ie they have only given up between 50 - 70 % of the rally from October lows

2. The media are extremely negative on everything.

3. Despite all the negativity surrounding the EURO €, also has held up relatively well

4. Likelihood is that the money is all betting on demise of Euro and Europe...

Looking at the EURO chart

Looks like we could be in falling wedge patterns

If we break out to upside (expected move) then in theory the entire falling wedge will be retraced..

(similar patterns also in AUDUSD and GBPUSD)

Wednesday, November 23, 2011

ALL BAD NEWS?!!!

FT and Marketwatch headlines for today...all negative news..note to self BEWARE of being short at these levels..

Many blogs are touting end of the world scenarios and 2008 comparisons

Holiday in US quiet trading for rest of week

Friday, November 18, 2011

Crude ready for a correction?

The news channels (CNBC etc) all highlighting crude as it hit 103 yesterday...not being a CYNIC but usually they get excited at the top of the market, anyway the chart shows crude had been straight up (more or less) since Oct 4

Time for a breather?

Time for a breather?

DAX daily A look at the CHOP!!

Well July to September was a noce move down and the rally off the lows in October was also a good tradeable move...NOW we are in that circle of CHOP///

Note: Key is preservation of capital...

Personally I feel the bullish scenario will win once this chop is over..too many bears looking for the drop, high VIX (volatility), and DESPITE the bad news, EU coming to an end, blah blah blah...we are in a CHOP...

Obviously as in all trading many scenarios could play out...but i give the BULLISH case 75% and the bearish case 25%..

Well it's FRIDAY so not a good day to bet big either way..

Short OIL

Long DAX

Short EURO/DOLLAR

Long FTSE (day trade)

Short DOW

DOW DAX spread chart

at these levels looks good to buy DAX and Sell DOW

Friday, November 11, 2011

DAX 4 hours...bigger picture

Well the negative news seems to not be able to drive the market significantly lower SO it seems that it will go higher...

Looking at the DAX 4 hr chart 2 scenarios

THE BEARISH CASE

possible H&S pattern with neckline at around 5730 (tested yesterday) and a price target of 5000 (September lows)

THE BULLISH CASE

We moved up from 23rd Sept low and have now retraced 50% of the move up (A to B), and could be in a bull flag formation, and pretty close to a break out to the upside (6000), with a min target of 6600 and possibly even as high as 7200..

LONG TERM

If we completed a wave 1 down at the Sept lows and we are now in a wave 2 up, wave 2's tend to bring back that bullish feeling and can even approach the highs, before we turn down in a WAVE 3 ..THE BIG ONE!!

SO a Xmas rally and into New Year before the next wave down occurs..

Looking at the DAX 4 hr chart 2 scenarios

THE BEARISH CASE

possible H&S pattern with neckline at around 5730 (tested yesterday) and a price target of 5000 (September lows)

THE BULLISH CASE

We moved up from 23rd Sept low and have now retraced 50% of the move up (A to B), and could be in a bull flag formation, and pretty close to a break out to the upside (6000), with a min target of 6600 and possibly even as high as 7200..

LONG TERM

If we completed a wave 1 down at the Sept lows and we are now in a wave 2 up, wave 2's tend to bring back that bullish feeling and can even approach the highs, before we turn down in a WAVE 3 ..THE BIG ONE!!

|

| DAX 4 hr chart |

Wednesday, November 9, 2011

DAX 2 hours

Well Europe still dominating the news and a lot of nervousness...but maybe too much for a serious market break down?

DAX 2 hours support at 5735 if we break down significantly may head to test lows at 5000..BUT probably a lot of market participants looking for the fall so BEWARE if a false break occurs, could be the thing that ignites the SANTA rally...and then head to 7000 before falling again...

be nimble!!

Thursday, October 6, 2011

Copper..short /medium term buy?

Pretty self explanatory..looks like we are in the "buy" zone, and good stop level (if we go below the red zone, history shows it can be a fast move down) not far away...anywhere near the blueish line ...a sell..

Wednesday, October 5, 2011

AUDUSD possible count

If we have completed a wave 3 the next move up will be a choppy wave 4, possibly to underside of wave 1. Then new lows.. This would tie in with a 4rth quarter rally in all risk assets (equities, commodities etc), and obviously a weakening of the US dollar vs most major currencies...

Sunday, September 18, 2011

DOW charts daily and monthly

Daily chart shows support and resistance..shaded areas.. We may be in process of forming bear flag..possibly still some higher prices to come. A break of 11,000 may signal start of next down leg. So probably more range bound trading for a while. before a decisive move (probability? 70% to downside?)

Weekly chart shows MACD turning down...and looks like crossing to downside...look at previous turn down..

Thursday, March 10, 2011

DAX 1 hr and 2 hr charts

DAX 1 hr chart showing classic triangle, false break a couple of days ago..subsequent shoer squeeze mad a lower high again, today we have the break lower. MIND the GAP DOWN...expecting a fill and add to short..if we get a close back in the triangle..stop out

2 hr chart shows longer view and target area, which can be seen to be previous support and resistance area.

Thursday, February 24, 2011

DAX FTSE spread..again

Well the spread went a little higher than anticipated...added to the position..but looks to be coming in now..

The negative divergence still in play, MACD turning down...

The negative divergence still in play, MACD turning down...

Tuesday, February 22, 2011

DAX monthly or L O N G T E R M ..!

DAX bumping up against some serious resistance around 7540 level..after breaking out of the 6440 level. Longer term we may see test of that level (6440).. shorter term support at 6950 and resistance around 7540...

Key levels to watch... so at 7440 good risk reward ( LONGER term) for a short...a break above 7540 and we test highs @ 8000 !

Key levels to watch... so at 7440 good risk reward ( LONGER term) for a short...a break above 7540 and we test highs @ 8000 !

Thursday, February 3, 2011

SOME more negative divergence CABLE

Shorted at 16210 stop 16320 open target...

If we do break higher could be an IHS formation ..

best seen on weekly chart

Of course being weekly chart important to see a confirmed break out and retest of theneck line..to avoid false breaks.

If we do break higher could be an IHS formation ..

best seen on weekly chart

Of course being weekly chart important to see a confirmed break out and retest of theneck line..to avoid false breaks.

Wednesday, February 2, 2011

FTSE DAX spread UPDATE.....

Following on form previous post...the spread got as high as 1270....now dropping back to 1187. As can be seen on the chart this is setting up an even bigger negative divergence, so we may have a PROPER top in the spread and LONGER term looks like FTSE will outperform the DAX (unless of course it breaks out above that channel.. TA always has alternative scenarios, it's all about probabilities!)

The weekly chart also shows negative divergence. If the spread narrows to 700, potential profit is 1000 pips per unit

The weekly chart also shows negative divergence. If the spread narrows to 700, potential profit is 1000 pips per unit

Wednesday, January 26, 2011

FTSE DAX spread

Looking at this..

Selling DAX simultaneously buying FTSE especially around 1200 spread....

IF markets start correcting FTSE has traditionally been more defensive than the DAX so in theory the spread should narrow as in previous market corrections/bear trends

Selling DAX simultaneously buying FTSE especially around 1200 spread....

IF markets start correcting FTSE has traditionally been more defensive than the DAX so in theory the spread should narrow as in previous market corrections/bear trends

FTSE follow up

Well the FTSE is retesting that broken trend line. Now what? Well the DOW is above 12k, DAX is still struggling against the highs, and actually any selling it seems to lose momentum pretty quickly....

SO my guess is this may turn quite quickly if any selling hits the US mkts. having said that am long FTSE from 5907 trailing stop now at around 5976, any sudden fall and I will be stopped out...

A good trade may be long FTSE short DAX....

SO my guess is this may turn quite quickly if any selling hits the US mkts. having said that am long FTSE from 5907 trailing stop now at around 5976, any sudden fall and I will be stopped out...

A good trade may be long FTSE short DAX....

Monday, January 24, 2011

FTSE topped or consolidating for another push up?

FTSE has broken the short term uptrend

Will it repeat the last down trend forming a BULL flag? One month it took...action in yellow circles

OR has it topped..? Likely test of the broken trend line at 5990 possible also a test of the highs...

Will it repeat the last down trend forming a BULL flag? One month it took...action in yellow circles

OR has it topped..? Likely test of the broken trend line at 5990 possible also a test of the highs...

Subscribe to:

Posts (Atom)